GLP-1 drugs began being approved by the US Federal Drug Administration for use in Type 2 Diabetics in 2005.[3] Their impact has been tremendous. The newest data shows that 1 in 7 Americans has tried or is currently on a GLP-1.[6] This article aims to answer the following questions: What is a GLP-1? Who is primarily using the GLP-1 drugs? What is the market impact on the protein?

What is GLP-1?

Glucagon-like-peptide-1, or GLP-1, is a hormone produced in the small intestine and is released following food consumption.[10]

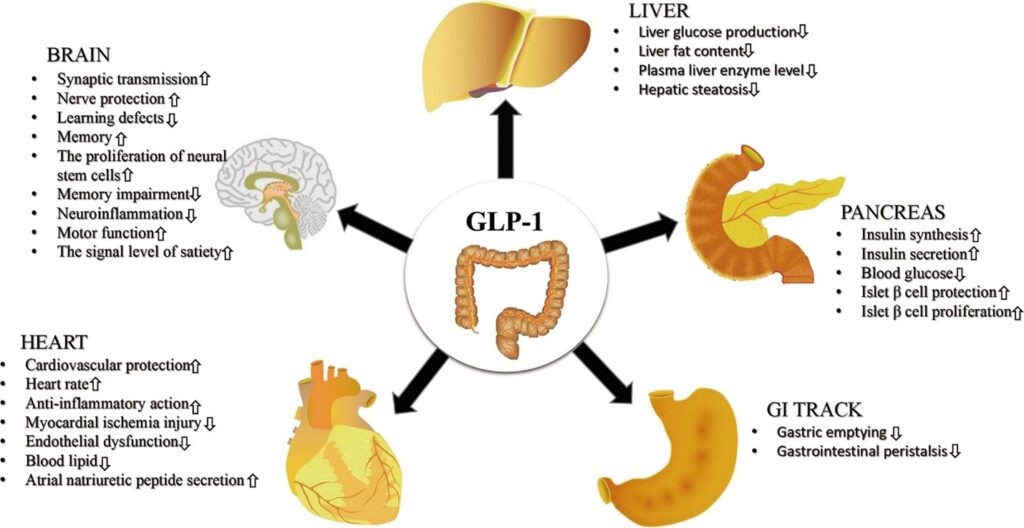

Typically, it is released in proportion to the calories consumed. It has a multitude of functions including the stimulation of insulin hormone which regulates blood sugar by storing energy, the inhibition of the ghrelin hormone which induces appetite, the stimulation of the sympathetic nervous system to increase energy expenditure and slow the movement of the gastrointestinal tract.[10]

Below is a visual representation of the effect of the GLP-1 drug on a multitude of body systems.[13] Essentially, GLP-1 drugs like Ozempic, Wegovy, etc. are making people less hungry by altering the hunger hormones and slowing down the gut so food doesn’t move as fast, thus keeping people feeling fuller, for longer. Those taking the drug can experience rapid weight loss, as well as significant side effects.

Figure 1: Visual representation of the effect of the GLP-1 drug on a multitude of body systems (Zhao, 2021)

GLP-1 Users

Seven out of 10 American adults are overweight or obese. [7] According to the World Health Organization, adult obesity has more than doubled since 1990. [8] This is not a high-income issue either, Africa has seen the number of overweight children under 5 years old increase by 12% since 2000.[8] In Asia, almost half of children under 5 are overweight or living with obesity.[8] The health risks of obesity, as well as additional healthcare costs are significant. Individuals with obesity are more likely to suffer from high blood pressure, stroke, heart disease and cancer. (Health Risks of Overweight & Obesity, n.d.) The introduction of the GLP-1 drugs to the market has shifted the approach to weight loss and management. According to the NIH (National Institute of Health), just 5% reduction from baseline weight is associated with meaningful clinical improvement. [2] However, findings suggest that the majority of individuals that start a GLP-1 do not take the medication for the recommended 12 weeks, suggesting they are not achieving clinically meaningful weight loss.[2] Currently, 1 in 8 American adults have used one of the GLP-1 drugs and at least 30% ceased before 4 weeks, likely due to gastrointestinal distress.[2] Additionally, it is reported that there were over 25,000 emergency room visits between 2022-2023 due to GLP-1 use. [5] Despite seemingly significant risk of side effects and lack of adherence to a drug regime, the prediction is that the market will continue to grow by 18% year over year. (U.S. Glp-1 Receptor Agonist Market Size & Outlook, n.d.) The American Academy of Pediatrics has shifted their position from “watchful waiting” to aggressive intervention to combat the childhood obesity epidemic, now recommending intervention therapy along with drugs like Ozempic for children 12 and older.[9] This shift in recommendation in late 2024 opens an entire new demographic for targeting the weight loss drug.

Eating Patterns

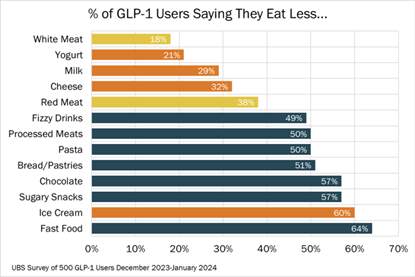

GLP-1 drugs work in multiple ways to reduce hunger, thus food consumption. Users report eating smaller and more frequent meals, as well as an overall reduction in what is generally considered “bad for you” foods like fast food and items high in sugar/fat (see Figure 2). This, coupled with a general rise in health consciousness and demand for more nutritionally dense foods, has led to a boom in the protein market.

Figure 2: How GLP-1 Drugs Influence Eating Habits and Food Choices [14]

Whey protein has been recognized for decades for its ability to absorb quickly promoting muscle maintenance, growth and repair. In the context of a GLP-1 user, it is an ideal supplementation. During the first month of GLP-1 use, it is estimated that individuals lose 60/40% fat and muscle, which is problematic.[6] Not only are users potentially getting “fatter” by proportion, but they are also losing skeletal muscle which is essential to blood sugar regulation and overall longevity. Grip strength, as an example, has widely been adopted as a singular indicator of overall strength and low grip strength is a predictor of all-cause mortality.[1] While it is unknown what level of protein supplementation is needed for cessation of muscle catabolism, new evidence suggests we do not know the upper limit of protein metabolism [11] suggesting that current recommendations of protein consumption are too low, especially in populations that have additional protein needs. There appears to be a race in the market to create the smallest volume product with the most available protein source.

Considering whey proteins score above almost all other proteins on the PDCAAS (Protein Digestibility Corrected Amino Acid Score) chart, the gold standard for assessing digestibility and absorption of amino acids, it has been a focus of product creation with more of an emphasis on WPI90 (90% protein by volume) as opposed to the historic leader, WPC80 (80% protein by volume). This trend paves the way for Native Whey protein (95% protein by volume), a little known more bioavailable and whey protein with a higher concentration of leucine per volume. Lactalis pioneered the development of this protein decades ago, and few have been able to replicate it. Through only cold-filtration, the whey protein is extracted absent the cheese-making process, leaving the proteins more intact and more readily absorbable by skeletal muscle. Since most consumers are unaware of where whey protein comes from, the story of Native Whey is slightly more challenging to communicate. However, with the general trend toward consumers label reading and intentionally looking for minimally processed foods, Native Whey has the potential to become a recognizable ingredient on nutrition labels.

References

[1] Bohannon, R. W. (2019). Grip Strength: An Indispensable Biomarker For Older Adults. Clin Interv Aging, 1681-1691.

[2] Franz, M. J. (2017). Weight Management: Obesity to Diabetes. Diabetes Spectrum, 149-153.

[3] GLP-1 Agonists: Wonder Drugs of the 21st Century? (2024, July 02). Retrieved from Yale School of Medicine: https://medicine.yale.edu/media-player/glp-1-agonists-wonder-drugs-of-the-21st-century/

[4] Health Risks of Overweight & Obesity. (n.d.). Retrieved from National Institute of Diabetes and Digestive and Kidney Diseases: https://www.niddk.nih.gov/health-information/weight-management/adult-overweight-obesity/health-risks

[5] Lovegrove, M. C. (2025). U.S. Emergency Department Visits Attributed by Clinicians to Semaglutide Adverse Events, 2022–2023. Annals of Internal Medicine, 898-900.

[6] Mozaffarian, D. (2025). Nutritional Priorities to support GLP-1 therapy for obesity: a joint Advisory from the American College of Lifestyle Medicine, the American Society for Nutrition, the Obesity Medecine Association, and The Obesity Society. The American Journal of Clinical Nutrition, 344-367.

[7] Obesity and Overweight. (2024, October 25). Retrieved from National Center for Health Statistics for the Center for Disease Control: https://www.cdc.gov/nchs/fastats/obesity-overweight.htm

[8] Obesity and overweight. (2025, May 7). Retrieved from World Health Organization: https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight

[9] Radde, K. (2023, January 9). Childhood obesity requires early, aggressive treatment, new guidelines say. Retrieved from National Public Radio: https://www.npr.org/2023/01/09/1147828006/childhood-obesity-requires-early-aggressive-treatment-new-guidelines-say

[10] Stipanuk, M., & Caudill, M. A. (n.d.). Biochemical, Physiological and Molecular Aspects of Human Nutrition (E-Book ed.). Elsevier Health Sciences.

[11] Trommelen, J. (2023). The anabolic response to protein ingestion during recovery from exercise has no upper limit in magnitude and duration in vivo in humans. Cell Reports Medicine.

[12] U.S. Glp-1 Receptor Agonist Market Size & Outlook. (n.d.). Retrieved from Horizon Grand View Research: https://www.grandviewresearch.com/horizon/outlook/glp-1-receptor-agonist-market/united-states

[13] Zhao, X. (2021). GLP-1 Receptor Agonists: Beyond Their Pancreatic Effects. Frontiers Endocrinology, Volume 12.

[14] Ever.Ag Insights. [En ligne] 10 Octobre 2025. https://insights.ever.ag/2024/04/15/phil-plourds-monday-morning-demand-notes-april-15/.